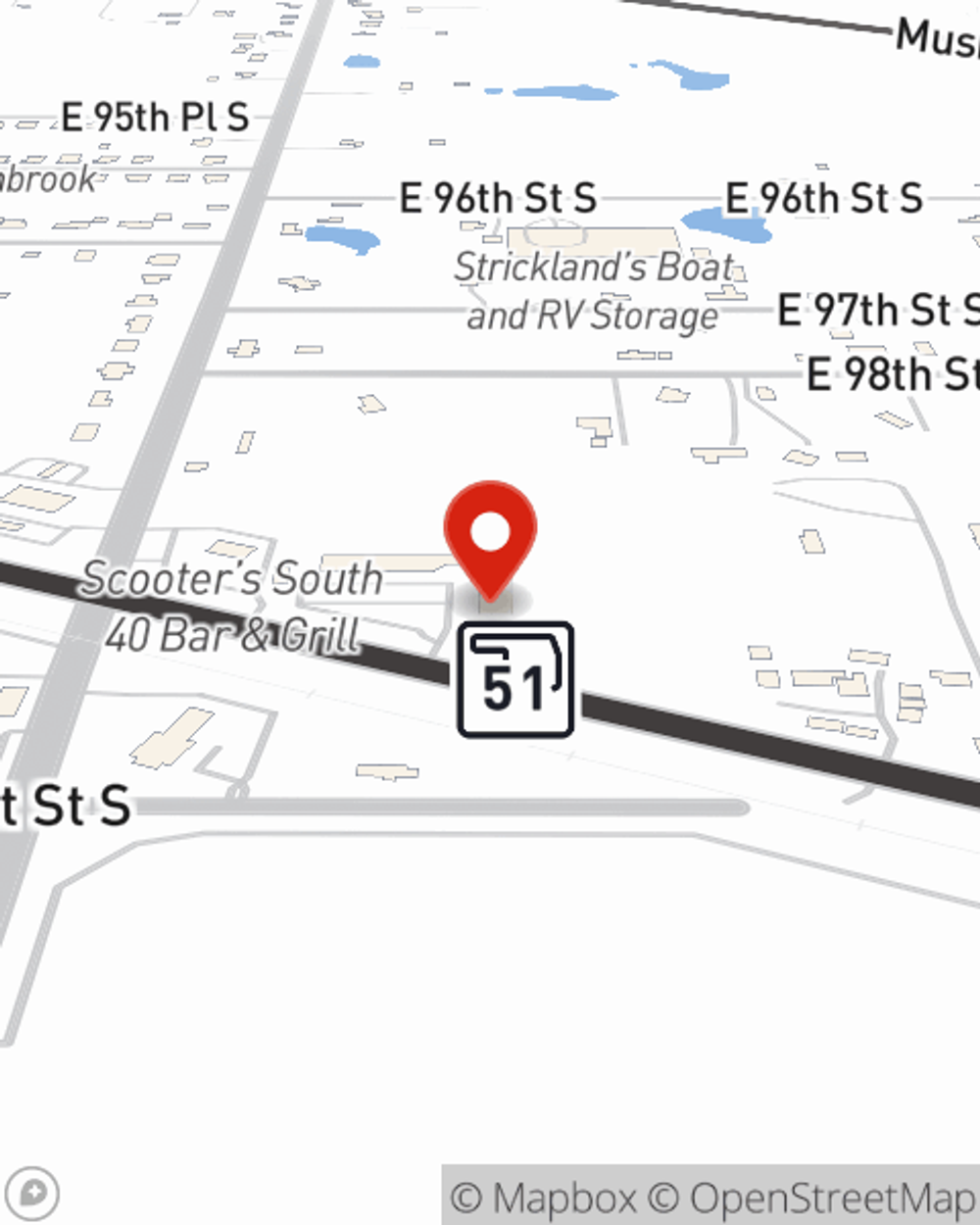

Life Insurance in and around Broken Arrow

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Providing for those you love is an honor and a joy. You advise them on important decisions go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

What are you waiting for?

State Farm Can Help You Rest Easy

You’ll get that and more with State Farm life insurance. State Farm has fantastic policy choices to keep those you love safe with a policy that’s adjusted to accommodate your specific needs. Fortunately you won’t have to figure that out by yourself. With strong values and fantastic customer service, State Farm Agent Brian Cannon walks you through every step to provide you with coverage that guards your loved ones and everything you’ve planned for them.

Interested in experiencing what State Farm can do for you? Visit agent Brian Cannon today to get to know your individual Life insurance options.

Have More Questions About Life Insurance?

Call Brian at (918) 627-0977 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Brian Cannon

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.